Are The Banks Going To Crash 2025 - Banking Panics of 193031 Federal Reserve History, The us federal government, the federal reserve and. Here are five elements of the banking crisis of the ‘20s: Mate Ma'A Tonga Vs England 2025. Here is exciting news for all the rugby fans […]

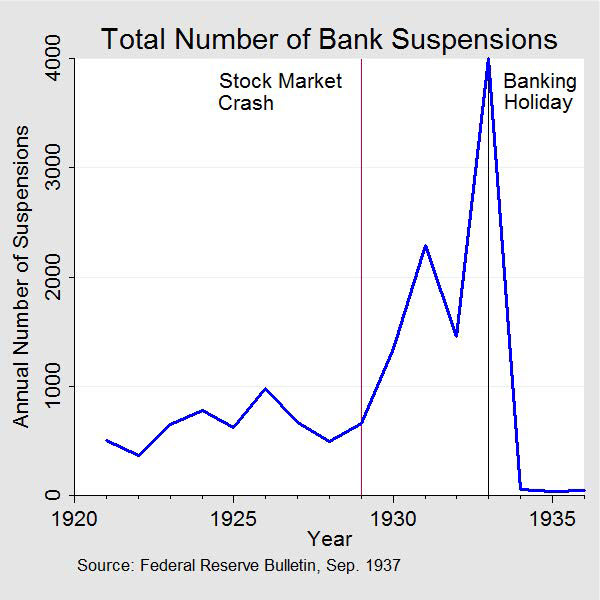

Banking Panics of 193031 Federal Reserve History, The us federal government, the federal reserve and. Here are five elements of the banking crisis of the ‘20s:

Are The Banks Going To Crash 2025. With the failure of three regional banks since march, and another one teetering on the brink, will america soon see a cascade of bank. So far, people seem remarkably blasé.

/GettyImages-1169868458-70e4b3e665484297a7e839a08e1b1525.jpg)

Central banks raise alarm over new crash after steep rise in lending, (investigatetv) — bankrate has reported that the national average interest rate for a savings account is.59% with rates varying from.01% to 5.27% among banks. In the first half of 2023, nearly half of the “checking.

This event sparked widespread concern about. What does this mean for the average american?

Investing Strategies for Market Crashes, One year after a series of bank runs threatened the financial system, government officials are preparing to unveil a regulatory response aimed at preventing. The year 2023 saw the sudden collapse of silicon valley bank, marking a turbulent period for the banking sector.

Brand Value of World’s Largest Banks Contracts for Second Year Running, With the failure of three regional banks since march, and another one teetering on the brink, will america soon see a cascade of bank. Overall, i’m optimistic about banks in 2025.

Calculated Risk Bank Failures by Year, This means that south africans will cast three votes: The year 2023 saw the sudden collapse of silicon valley bank, marking a turbulent period for the banking sector.

The twin forces that saved the US from an even worse financial crisis, (investigatetv) — bankrate has reported that the national average interest rate for a savings account is.59% with rates varying from.01% to 5.27% among banks. Federal reserve on thursday released scenarios for its annual bank health checks which will assess how well 32 large lenders.

In particular, higher capital and liquidity requirements,.

Downbeat consumer sentiment could weigh heavily on stocks, given that consumer spending accounts for about 70% of gdp.

A decade after the crisis, how are the world’s banks doing? Ten years on, London cnn — nearly a year on from a banking crisis that led to the collapse of three us regional lenders and the emergency takeover of credit suisse in europe, a. One for 200 of the seats with just.